Cryptocurrency mining is the bedrock upon which the edifice of digital currency stands. It’s a critical process that not only generates new coins but also maintains the ledger of transactions upon which cryptocurrencies operate. This introductory section will elucidate the concept of cryptocurrency mining, its role in blockchain technology, and its evolution over time.

What is Cryptocurrency Mining?

At its core, cryptocurrency mining is the process by which transactions are verified and added to the public ledger, known as the blockchain. Miners use powerful computers to solve complex mathematical problems that validate transaction blocks. The first miner to solve the problem gets to add the block to the blockchain and is rewarded with a certain number of cryptocurrency coins.

The Role of Mining in Blockchain Technology

Mining serves two primary purposes in the realm of cryptocurrencies:

- Transaction Verification: Every transaction made with a cryptocurrency needs to be confirmed and recorded. Mining computers collect hundreds of transactions into a block and then seal it cryptographically by solving a complex mathematical puzzle.

- Currency Issuance: Mining is also the mechanism by which new cryptocurrency coins are created. As a reward for their efforts in maintaining the network, miners receive a predetermined number of new coins.

Brief History of Cryptocurrency Mining

The history of cryptocurrency mining is inextricably linked to the history of Bitcoin, the first cryptocurrency. In the early days of Bitcoin, mining could be done on a standard desktop computer. But as the network grew, so did the difficulty of the mining process, leading to the need for more specialized hardware.

The Transition from Hobby to Industry

Initially, cryptocurrency mining was a hobby for tech enthusiasts. However, as the potential for profit grew, so did the scale of operations. Today, mining is a highly competitive industry dominated by specialized companies with massive mining farms.

Understanding the Mining Process

The mining process is the heart of the cryptocurrency ecosystem. It’s a sophisticated sequence of actions that ensures the integrity and functionality of a blockchain. Let’s break down this process step by step.

How Transactions are Verified

When a user initiates a cryptocurrency transaction, it is broadcast to a network of peer-to-peer computers scattered across the world. These transactions aren’t immediately added to the blockchain; instead, they remain in a pool of unconfirmed transactions. Here’s what happens next:

- Transaction Collection: Miners select transactions from this pool to form a new block of data.

- Verification: Each transaction is verified for its validity; the digital signatures are checked to ensure that the transaction is authorized by the sender.

- Block Construction: Once verified, transactions are compiled into a block.

The Concept of Proof of Work (PoW)

Proof of Work is the algorithm that secures many cryptocurrencies, including Bitcoin. It involves solving a cryptographic puzzle, which requires computational power. The process is as follows:

- Nonce Discovery: Miners compute a “nonce,” a random string of numbers that, when hashed with the block data, produces a result within the network’s target.

- Hashing: The block header is hashed repeatedly until a miner finds a nonce that gives a hash value below a certain target.

- Block Addition: The miner who finds the correct nonce broadcasts the new block to the network. Other miners verify the solution and, if correct, add the block to their version of the blockchain.

Alternative Consensus Mechanisms

While PoW is the original consensus mechanism, it’s not the only one. Due to concerns about energy consumption and efficiency, alternative mechanisms have been developed:

- Proof of Stake (PoS): Instead of miners, there are validators who are chosen to create new blocks based on the number of coins they hold and are willing to “stake” as collateral.

- Delegated Proof of Stake (DPoS): A variation of PoS, where stakeholders vote for delegates to secure the network. It’s designed to be more efficient and democratic.

- Proof of Authority (PoA): Transactions and blocks are validated by approved accounts, known as validators. It’s faster and more energy-efficient than PoW.

Each of these mechanisms has its own set of rules and processes, but they all serve the same purpose: to achieve consensus on the blockchain in a trustless environment.

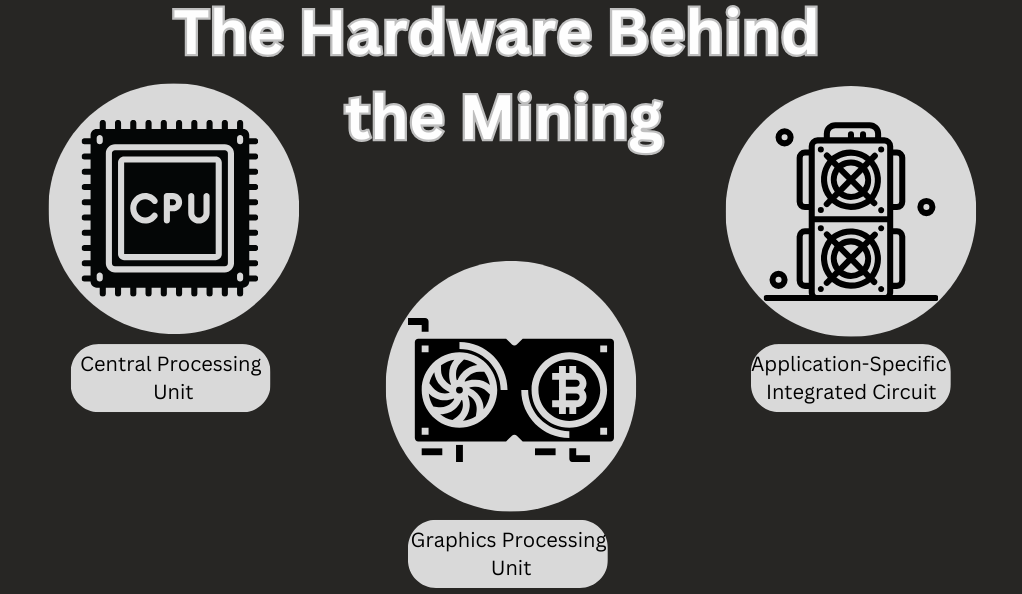

The Hardware Behind the Mining

Mining hardware is the physical component that performs the mining process. Over the years, the hardware has evolved to become more specialized and efficient. Let’s explore the different types of mining hardware.

CPU, GPU, and ASIC Miners: What’s the Difference?

- CPU (Central Processing Unit): The CPU is the brain of the computer and can handle a variety of tasks, including mining. However, it’s the least powerful method for mining cryptocurrency today.

- GPU (Graphics Processing Unit): GPUs are more efficient than CPUs because they can perform parallel operations, making them better suited for the cryptographic calculations required for mining.

- ASIC (Application-Specific Integrated Circuit): ASICs are custom-built for a specific purpose, in this case, mining cryptocurrency. They offer the highest efficiency and performance but are also the most expensive option.

The Evolution of Mining Hardware

The transition from CPUs to GPUs to ASICs represents the increasing professionalization of cryptocurrency mining. Each leap in hardware technology brought about a significant increase in computational power, but also a rise in the cost of entry.

Setting Up a Mining Rig: Basics for Beginners

For those interested in starting their mining journey, setting up a mining rig requires careful consideration of the following:

- Hardware Selection: Choose between CPU, GPU, and ASIC based on budget and objectives.

- Mining Software: Select software compatible with your hardware and the cryptocurrency you wish to mine.

- Energy Consumption: Calculate the energy costs, as mining can be power-intensive.

- Cooling Systems: Ensure adequate cooling to prevent overheating.

- Internet Connection: A stable and fast internet connection is crucial for mining.

Software and Mining Pools

The hardware may form the backbone of cryptocurrency mining, but it’s the software that brings it to life. Mining software connects your hardware to the blockchain and the mining pool if you’re part of one. Let’s explore the intricacies of mining software and the collaborative world of mining pools.

Choosing the Right Mining Software

Mining software is responsible for delivering the work to the miners, receiving the completed work from the miners, and transmitting this information back to the blockchain and mining pool. Here’s what to consider when choosing mining software:

- Compatibility: Ensure the software is compatible with your hardware and the cryptocurrency you intend to mine.

- Usability: Look for user-friendly interfaces if you’re a beginner. Advanced users may prefer more customizable options.

- Features: Some software offers advanced features like overclocking and monitoring.

- Reputation: Opt for software with a strong reputation and a large user base.

The Function and Importance of Mining Pools

A mining pool is a group of miners who combine their computational resources over a network to strengthen the probability of finding a block or mining a piece of a block. Here’s why they’re important:

- Increased Chances: By pooling resources, miners have a higher chance of completing blocks and receiving rewards.

- Regular Payouts: Mining pools often result in more regular payouts, albeit smaller, compared to solo mining.

- Reduced Variance: Pools reduce the variance in miner income by providing more consistent, but smaller, rewards.

How to Join a Mining Pool and Start Mining

Joining a mining pool is a straightforward process:

- Research: Find a pool that suits your needs in terms of fees, payout structure, and reliability.

- Sign Up: Create an account on the pool’s website.

- Configure Mining Software: Use the information provided by the pool to configure your mining software.

- Start Mining: Once everything is set up, start mining and monitor your progress.

Economics of Mining

Mining is not just a technical challenge; it’s also an economic one. The profitability of mining can fluctuate based on several factors.

Cost Analysis: Electricity and Hardware

The two primary expenses in mining are electricity and hardware. Mining consumes a significant amount of power, and the cost can vary greatly depending on your location. Hardware is a capital expense that can depreciate over time, especially as newer and more efficient technologies emerge.

Understanding Mining Profitability

Mining profitability is a calculation that takes into account the cost of electricity, hardware, and other expenses against the value of the cryptocurrency being mined. Several online calculators can help miners estimate their potential earnings.

Risks and Rewards of Investing in Mining

Investing in mining hardware and operations involves a certain level of risk:

- Market Volatility: The price of cryptocurrencies can be highly volatile, affecting profitability.

- Technological Advancement: Newer, more efficient mining technologies can make older equipment obsolete.

- Regulatory Changes: Changes in regulations can have positive or negative impacts on the viability of mining operations.

Challenges and Solutions in Mining

Cryptocurrency mining faces several challenges, from scalability issues to environmental concerns.

Dealing with Scalability and Energy Consumption

The energy consumption of mining operations has been a topic of intense debate. Solutions include:

- Renewable Energy: Many mining operations are transitioning to renewable energy sources to reduce their carbon footprint.

- Scalability Solutions: Innovations like the Lightning Network aim to reduce the load on the blockchain, thereby decreasing the energy required for mining.

The Impact of Mining on the Environment

The environmental impact of mining is a concern due to the use of fossil fuels in many parts of the world. The community is actively looking for greener alternatives and more energy-efficient consensus mechanisms.

Innovations in Sustainable Mining Practices

The industry is exploring various avenues to make mining more sustainable, such as:

- Heat Reutilization: Using the excess heat generated from mining operations for heating homes and offices.

- Dual-Purpose Mining Farms: Combining mining operations with data centers to maximize the utility of the energy consumed.

The Future of Cryptocurrency Mining

As we look ahead, the landscape of cryptocurrency mining is poised for continued evolution. Technological advancements, regulatory shifts, and the ever-changing dynamics of the market all play a role in shaping the future of this industry. Let’s explore some of the trends and preparations miners and investors can anticipate.

Trends Shaping the Future of Mining

The future of mining is being shaped by several key trends:

- Decentralization Efforts: In response to the centralization of mining power in large farms, there’s a push towards more decentralized mining solutions to prevent any single entity from gaining too much control over the blockchain.

- Energy-Efficient Hardware: As concerns about sustainability grow, the demand for energy-efficient mining hardware is likely to increase.

- Cloud Mining: This service allows individuals to participate in mining without owning the physical hardware, making mining more accessible.

The Role of Regulations in Mining Operations

Regulations will continue to impact the mining industry significantly:

- Legal Frameworks: Countries are developing legal frameworks to govern mining operations, which could affect how and where mining can take place.

- Taxation: As cryptocurrencies gain mainstream acceptance, governments are more likely to introduce tax regulations affecting mining profits.

Preparing for Changes in Cryptocurrency Mining Dynamics

To stay ahead, miners and investors must be prepared for changes:

- Stay Informed: Keeping up with the latest technological and regulatory changes is crucial.

- Diversify: Diversifying mining activities across different cryptocurrencies can mitigate risks.

- Community Engagement: Participating in mining and cryptocurrency forums can provide insights and help influence the direction of the industry.

Staying Secure and Legal

Security and legality are paramount in the world of cryptocurrency mining. Ensuring that operations are secure and compliant with local laws is essential for long-term success.

Best Practices for Mining Security

Miners must adopt best practices to secure their operations:

- Regular Updates: Keep all mining software and firmware up to date to protect against vulnerabilities.

- Secure Networks: Use secure networks and consider VPNs to protect against potential attacks.

- Hardware Security: Physical security measures are necessary to prevent theft of the mining hardware.

Navigating the Legal Landscape of Cryptocurrency Mining

Understanding and complying with the legal landscape is critical:

- Local Laws: Be aware of the local laws and regulations regarding cryptocurrency mining in your jurisdiction.

- International Regulations: For those operating across borders, international regulations may also apply.

Reporting and Taxes for Cryptocurrency Mining

Tax obligations must be taken seriously:

- Income Reporting: In many jurisdictions, income from mining must be reported for tax purposes.

- Tax Guidance: Seek professional tax advice to ensure compliance and optimize tax obligations.

Conclusion: Understanding Cryptocurrency Mining

Cryptocurrency mining is a cornerstone of blockchain technology, offering both challenges and opportunities. It’s a field that balances technical savvy with the volatility of digital currencies. As the industry progresses towards greater efficiency and sustainability, mining remains a vital part of the cryptocurrency ecosystem, open to all who are willing to engage with its complexities and contribute to its future.