In the fast-paced and ever-evolving world of digital assets, cryptocurrency mining has emerged as a lucrative venture for many. By leveraging powerful computer hardware, miners solve complex mathematical problems, validate transactions on the blockchain, and in return, earn cryptocurrency rewards. The potential for profitability in this domain has piqued the interest of enthusiasts and investors alike, making it crucial to understand the dynamics of cryptocurrency mining and how to maximize returns.

Cryptocurrency mining is not a one-size-fits-all affair. The choice of which cryptocurrency to mine can significantly impact your potential earnings. With hundreds of cryptocurrencies available, each with its unique mining algorithms and market dynamics, selecting the most profitable option requires careful consideration and a strategic approach.

The profitability of mining is influenced by a myriad of factors including the efficiency of your mining hardware, electricity costs, and the current market price of the cryptocurrency. Additionally, the mining difficulty, which adjusts over time based on the total computational power of the network, plays a crucial role in determining potential earnings. A lower difficulty means less competition for block rewards, while a higher difficulty requires more computational power to earn the same amount.

Understanding Cryptocurrency Mining

Cryptocurrency mining is a complex process that plays a crucial role in maintaining the integrity and security of blockchain networks. Miners use powerful computers to solve cryptographic puzzles, validating transactions and adding them to the blockchain in the form of blocks. This not only secures the network but also creates new units of the cryptocurrency, which are awarded to the miners as compensation for their efforts.

Overview of the hardware and software

The hardware used for mining ranges from standard CPUs to advanced ASICs (Application-Specific Integrated Circuits), with GPUs (Graphics Processing Units) being a popular choice due to their balance of cost and efficiency. The choice of hardware significantly impacts the miner’s ability to compete and earn rewards.

Software is another critical component of mining. Mining software connects the miner’s hardware to the blockchain network, enabling them to participate in the validation and addition of transactions to the blockchain. The software also links the miner to a mining pool if they choose to join one, distributing the computational workload and rewards among multiple participants.

Factors that affect mining profitability

Mining profitability is influenced by several factors, including the efficiency of the mining hardware, the cost of electricity, and the current market price of the cryptocurrency being mined. The network difficulty, which adjusts to maintain a consistent block time as the total computational power of the network changes, also plays a significant role. A lower difficulty means that less computational power is required to earn rewards, while a higher difficulty necessitates more powerful hardware.

The choice of mining pool is another crucial consideration. Mining pools are groups of miners who combine their computational power to increase their chances of earning rewards. In return for their participation, miners receive a portion of the rewards earned by the pool, proportional to their contributed computational power. Joining a mining pool can provide a more consistent income stream, especially for those with less powerful hardware.

Criteria for Choosing a Profitable Cryptocurrency to Mine

Selecting the right cryptocurrency to mine is a decision that requires careful consideration of various factors. The profitability of mining a particular cryptocurrency can fluctuate significantly over time, influenced by changes in network difficulty, block rewards, and market prices.

Network Difficulty

The network difficulty of a cryptocurrency is a measure of how challenging it is to mine a new block. As more miners join the network, the difficulty increases, requiring more computational power to earn the same amount of cryptocurrency. Conversely, if miners leave the network, the difficulty decreases. Miners should pay close attention to network difficulty trends, as lower difficulty can lead to higher profitability.

Block Reward

The block reward is the amount of cryptocurrency awarded to miners for validating a new block. It is essential to consider not only the current block reward but also any potential future changes. Some cryptocurrencies reduce the block reward over time, a process known as halving, which can significantly impact future earnings.

Price Volatility

Cryptocurrencies are known for their price volatility. The market price of a cryptocurrency can fluctuate wildly in a short period, affecting mining profitability. Miners should consider both the current price and the potential for future price increases or decreases when choosing a cryptocurrency to mine.

Mining Pools

Joining a mining pool can increase the consistency of mining rewards, especially for miners with less powerful hardware. However, it’s important to research and choose a reputable mining pool with a fair reward distribution system and low fees.

Long-Term Viability

The long-term viability of a cryptocurrency should also be considered. Cryptocurrencies that have a strong development team, active community, and real-world use cases are more likely to succeed in the long term, potentially leading to higher future profitability.

Energy Efficiency

The energy efficiency of the mining hardware and the cost of electricity in the miner’s location are critical factors in mining profitability. Miners should aim to use the most energy-efficient hardware available and consider renewable energy sources to reduce costs.

Legal and Regulatory Environment

Finally, the legal and regulatory environment of the miner’s location can impact profitability. Some regions have strict regulations or high taxes on cryptocurrency mining, while others offer incentives. It’s important to be aware of and comply with any local regulations.

Top 5 Most Profitable Cryptocurrencies to Mine in 2023

The landscape of cryptocurrency mining is constantly evolving, with new cryptocurrencies emerging and existing ones undergoing changes in network difficulty, block rewards, and market value. Here, we delve into the top 5 most profitable cryptocurrencies to mine in 2023, based on their potential for profitability and growth.

1. Bitcoin (BTC)

Bitcoin remains the most well-known and widely used cryptocurrency, with a strong network and high market value. Despite the high network difficulty and substantial energy requirements, mining Bitcoin can still be profitable, especially with access to cheap electricity and efficient mining hardware. The upcoming halving event, expected in 2024, will reduce the block reward but could also lead to an increase in Bitcoin’s value, potentially enhancing mining profitability.

2. Ethereum (ETH)

Ethereum has undergone significant changes with its transition to Ethereum 2.0 and the shift to a Proof-of-Stake consensus mechanism, rendering traditional mining obsolete. However, Ethereum Classic (ETC), a fork of Ethereum, continues to support mining. With a lower network difficulty compared to Bitcoin and a strong market presence, Ethereum Classic presents a profitable mining opportunity, particularly for those with existing Ethereum mining hardware.

3. Litecoin (LTC)

Litecoin, created as the “silver to Bitcoin’s gold,” offers quicker transaction times and a different hashing algorithm (Scrypt). The Scrypt algorithm is less memory-intensive, making Litecoin a popular choice for individual miners without access to large mining farms. With a strong market presence and consistent demand, Litecoin remains a profitable option for miners.

4. Monero (XMR)

Monero is a privacy-focused cryptocurrency that uses the RandomX hashing algorithm, designed to be ASIC-resistant and favor CPU and GPU mining. This makes Monero an attractive option for individual miners and those looking to utilize existing computer hardware for mining. With a strong commitment to privacy and security, Monero has maintained a loyal user base and steady market demand.

5. Ravencoin (RVN)

Ravencoin, designed to facilitate asset transfers on the blockchain, uses the KAWPOW hashing algorithm, which is ASIC-resistant and optimized for GPU mining. With a strong community and development team, Ravencoin has experienced growth in both network size and market value. The lower network difficulty and potential for future growth make Ravencoin an intriguing option for miners.

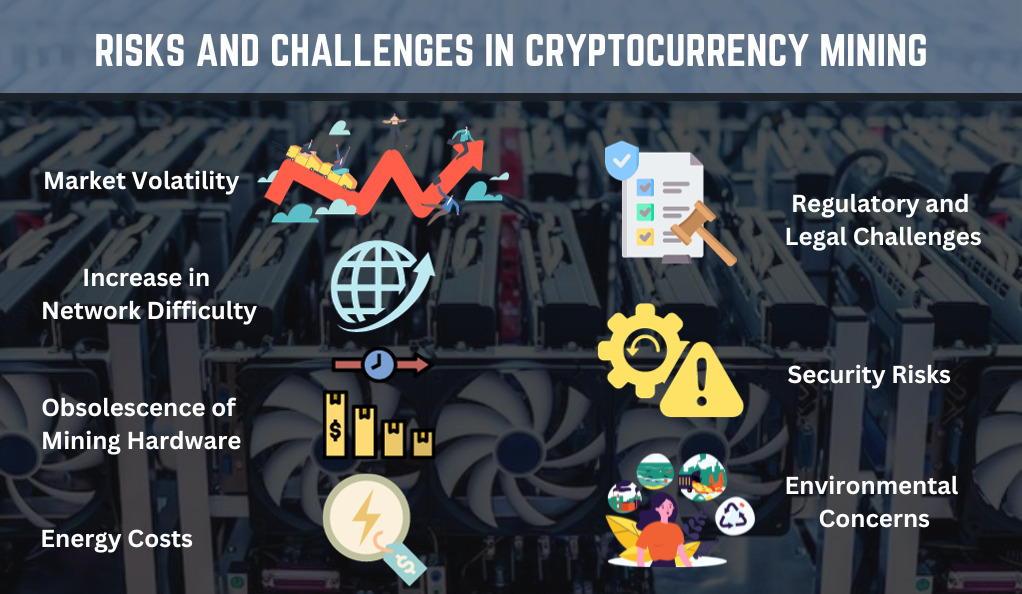

Risks and Challenges in Cryptocurrency Mining

Engaging in cryptocurrency mining presents a set of unique risks and challenges that miners need to navigate to ensure profitability and sustainability. Awareness and strategic planning are key to mitigating these risks.

Market Volatility

Cryptocurrency prices are notoriously volatile, with significant price fluctuations occurring within short periods. This volatility can drastically affect mining profitability, as the value of rewards can decrease rapidly. Miners need to stay updated on market trends and be prepared for sudden changes in cryptocurrency values.

Increase in Network Difficulty

The network difficulty of a cryptocurrency adjusts over time based on the total computational power of the network. An increase in network difficulty means that more computational power is required to mine new blocks, which can reduce the profitability of mining, especially for those with less powerful hardware.

Obsolescence of Mining Hardware

The rapid pace of technological advancement in mining hardware can render existing hardware obsolete, reducing its efficiency and profitability. Miners need to regularly assess their hardware’s performance and be prepared to upgrade when necessary to maintain competitiveness.

Energy Costs

Mining requires a significant amount of electrical power, making energy costs a major factor in profitability. Miners in regions with high electricity prices may find it challenging to achieve profitability. Utilizing energy-efficient hardware and exploring renewable energy sources can help mitigate these costs.

Regulatory and Legal Challenges

The legal and regulatory environment surrounding cryptocurrency mining varies across regions. Some countries have embraced mining, while others have imposed strict regulations or outright bans. Miners need to be aware of and comply with local regulations to avoid legal repercussions and potential loss of assets.

Security Risks

Mining involves the use of digital assets, which are susceptible to hacking and other security breaches. Miners must implement robust security measures to protect their assets and mining operations from malicious actors.

Environmental Concerns

The environmental impact of cryptocurrency mining, particularly the energy consumption and electronic waste associated with it, has come under scrutiny. Miners are encouraged to consider the environmental impact of their operations and explore sustainable practices.

By being aware of these risks and challenges and implementing strategies to mitigate them, miners can enhance the stability and profitability of their mining operations, ensuring a more secure and lucrative venture.

Tips and Strategies for Successful Cryptocurrency Mining

Achieving success in cryptocurrency mining requires a combination of technical knowledge, strategic planning, and continual optimization. Here are some tips and strategies to help miners maximize their profitability and efficiency.

Optimize Mining Hardware

Ensuring that mining hardware is operating at peak efficiency is crucial. Regular maintenance, adequate cooling, and firmware updates can help maintain performance and prolong the lifespan of mining equipment.

Choose the Right Mining Software

Selecting the appropriate mining software that is compatible with the hardware and offers user-friendly interfaces and robust features can enhance the mining experience and efficiency.

Join a Reputable Mining Pool

For those with less powerful hardware, joining a mining pool can provide more consistent rewards. It’s important to choose a reputable pool with fair reward distribution and low fees.

Monitor and Manage Expenses

Keeping track of all mining-related expenses, including hardware, electricity, and maintenance costs, is essential for calculating profitability and ensuring that the mining operation is financially sustainable.

Stay Updated on Market Trends

The cryptocurrency market is constantly evolving. Staying informed about market trends, network difficulty changes, and upcoming events can help miners make timely decisions to optimize their operations.

Implement Robust Security Measures

Protecting digital assets and mining operations from theft and security breaches should be a top priority. Utilizing secure wallets, employing strong passwords, and implementing two-factor authentication can enhance security.

Consider Environmental Impact

Exploring renewable energy sources and adopting energy-efficient practices can help reduce the environmental impact of mining operations and contribute to sustainable practices in the industry.

By following these tips and strategies, miners can enhance the profitability and efficiency of their operations, ensuring a successful and rewarding venture in cryptocurrency mining.

Conclusion

Cryptocurrency mining presents a unique opportunity for individuals to participate in the digital asset space, offering the potential for substantial rewards. However, it is a venture that requires careful consideration, strategic planning, and continual optimization.

The top 5 cryptocurrencies highlighted in this article—Bitcoin, Ethereum Classic, Litecoin, Monero, and Ravencoin—offer promising opportunities for profitability in 2023. By understanding the factors that influence mining profitability, staying informed about market trends, and implementing best practices, miners can optimize their operations and maximize their returns.

As with any investment, it’s crucial to conduct thorough research, consider potential risks, and implement strategies to mitigate these risks. Cryptocurrency mining is a constantly evolving field, and staying adaptable and informed is key to success.