Ripple’s XRP has emerged as one of the most intriguing and talked-about cryptocurrencies in the financial world. Since its inception in 2012 by Ripple Labs Inc., XRP has strived to differentiate itself from other cryptocurrencies by focusing on real-world applications, particularly in the banking and financial sectors. However, the potential of XRP extends far beyond these traditional domains, opening up a plethora of opportunities in various industries.

A Brief Overview of Ripple and XRP

Ripple serves dual roles as both a platform for fast, cheap transactions and a digital currency. The Ripple platform is an open-source protocol, designed for swift and economical transactions. Unlike Bitcoin, which wasn’t designed primarily as a payment system, Ripple aims to dominate global international transactions. This goal is quite ambitious, and it raises the question: could currency exchanges become obsolete in a few decades?

XRP, Ripple’s digital currency, operates on its network, bridging various fiat currencies for efficient, cost-effective transfers and settlements. Known for its speed and scalability, XRP can process 1,500 transactions per second, rivaling Visa’s throughput.

The Evolution of XRP

Since its release, XRP has undergone significant changes and developments. Initially, it was created to serve as a more efficient and decentralized alternative to existing payment systems like SWIFT. Over the years, Ripple Labs has worked tirelessly to enhance the functionality, security, and accessibility of XRP, making it one of the most advanced cryptocurrencies in existence.

Exploring Use Cases Beyond Banking

XRP has made significant strides in banking and finance, but its potential reaches far beyond, poised to transform various industries. It stands ready to revolutionize sectors from remittances and cross-border transactions to smart contracts and decentralized applications. This article will delve into these varied applications, highlighting XRP’s role not just as a cryptocurrency, but as a versatile tool fostering innovation and efficiency across domains.

By grasping Ripple and XRP’s foundational technology, their evolution, and their potential beyond banking, we gain a thorough understanding of XRP’s prominence in today’s cryptocurrency market.

Ripple’s Foundational Technology

To fully grasp the extensive applications of Ripple’s XRP beyond banking, it is crucial to delve into the foundational technology that powers Ripple and understand how XRP fits into this innovative ecosystem.

Understanding the Ripple Protocol

Ripple operates on an open-source protocol, aiming to enable fast, secure, and low-cost international money transfers. Unlike traditional banking systems and other cryptocurrencies like Bitcoin, Ripple doesn’t rely on a blockchain. Instead, it uses a unique distributed consensus mechanism through a network of servers to validate transactions.

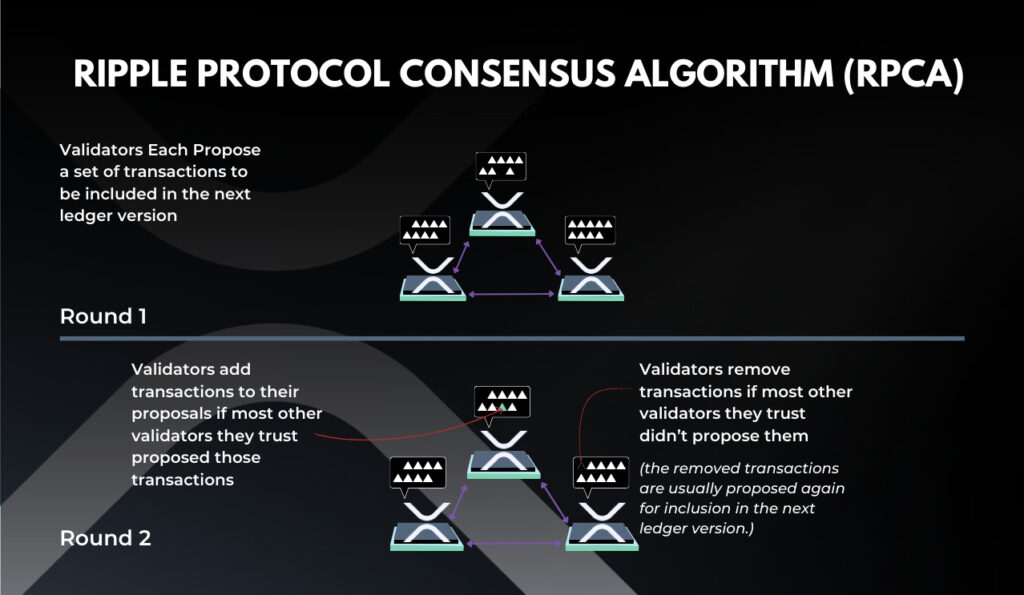

The Ripple protocol consensus algorithm (RPCA), is applied every few seconds by all nodes, in order to maintain the correctness and agreement of the network. Once consensus is reached, the current ledger is considered “closed” and becomes the last-closed ledger. Assuming that there is no malicious intent or faulty settings among nodes, the last-closed ledger maintained by the network should be identical across all nodes.

How XRP Fits into the Ripple Ecosystem

XRP is the native cryptocurrency of the Ripple network and plays a critical role in supporting its functionality. Here’s how it fits into the Ripple ecosystem:

- Bridge Currency: XRP acts as a bridge between different fiat currencies, allowing money to be transferred and settled in a more efficient way.

- Spam Prevention: XRP is used to prevent spam transactions. Each transaction on the Ripple network requires a small amount of XRP as a fee, discouraging malicious users from flooding the network.

- Quick Settlement: XRP transactions are confirmed within 4-5 seconds, making it one of the fastest cryptocurrencies.

The Role of Consensus and Security in Ripple’s Network

Security and integrity of transactions are paramount in any financial system, and Ripple is no exception. The Ripple network achieves consensus quickly and efficiently, ensuring that all transactions are secure and irreversible.

- Consensus Protocol: Ripple’s consensus protocol ensures that all nodes in the network agree on the validity of transactions in a decentralized manner, without the need for a central authority.

- Security: The Ripple network is designed to be secure against malicious attacks. The consensus protocol ensures that even if some nodes are not following the rules or are trying to submit false transactions, the network will still reach consensus and the integrity of the network will be maintained.

| Feature | Ripple/XRP | Traditional Banking | Other Cryptocurrencies |

|---|---|---|---|

| Transaction Speed | 4-5 seconds | Days | Minutes to hours |

| Scalability | 1,500 transactions per second | Limited | Varies (7 for Bitcoin) |

| Consensus Mechanism | Ripple Protocol Consensus (RPCA) | Centralized clearinghouses | Proof of Work, Proof of Stake |

| Security | Distributed consensus | Centralized security protocols | Decentralized, depends on protocol |

| Transaction Cost | Negligible | High (especially for international transfers) | Low to high, depending on network congestion |

| Accessibility | Open-source, decentralized | Requires a bank account | Open-source, decentralized |

This table highlights the stark contrasts between Ripple/XRP, traditional banking systems, and other cryptocurrencies, showcasing Ripple’s efficiency, speed, and low transaction costs.

XRP in Remittances and Cross-Border Transactions

One of the most promising applications of Ripple’s XRP lies in the realm of remittances and cross-border transactions. The traditional process of sending money across borders is often slow, expensive, and laden with intermediaries. XRP, with its fast transaction times and low fees, presents a compelling solution to these issues.

Revolutionizing Remittances with XRP

Remittances constitute a significant financial flow in many developing countries. Workers send a portion of their income to their families back home, which can be a lifeline for communities with limited access to financial services. However, the cost of sending remittances through traditional channels can be prohibitively high.

XRP offers a more efficient alternative. By acting as a bridge currency, XRP enables the conversion of one fiat currency to another without the need for multiple intermediaries. This not only speeds up the transaction time but also significantly reduces the cost.

Impact on Transaction Speed and Cost

The impact of XRP on transaction speed and cost in cross-border payments is significant:

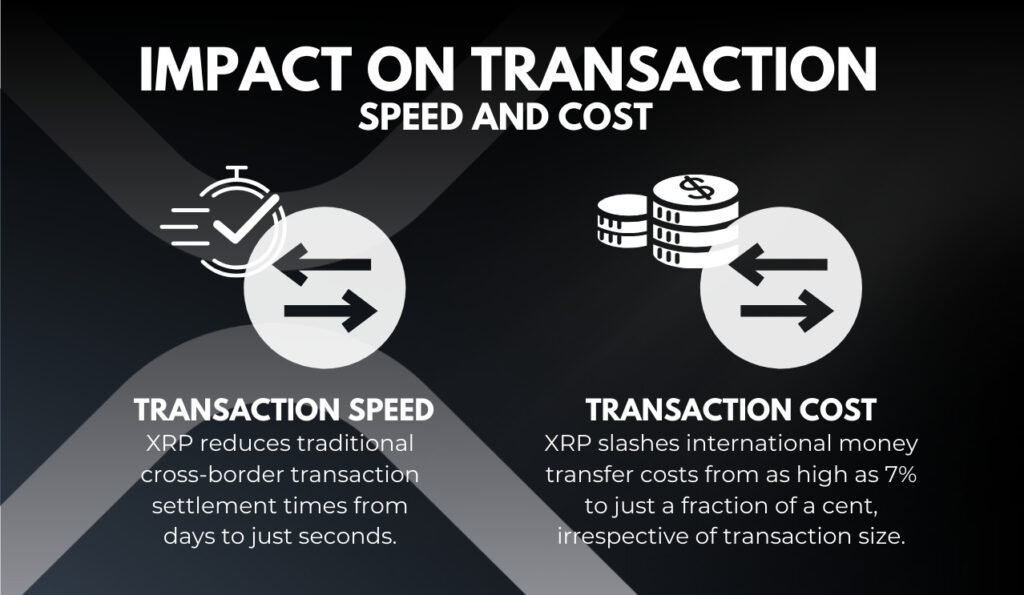

- Transaction Speed: Traditional cross-border transactions can take several days to settle. With XRP, the transaction time is reduced to a matter of seconds.

- Transaction Cost: The cost of sending money internationally can be as high as 7% of the transaction amount. XRP reduces this cost to a fraction of a cent, regardless of the transaction size.

| Feature | Traditional Banking | XRP-Based Transactions |

|---|---|---|

| Transaction Speed | Several days | 4-5 seconds |

| Cost | Up to 7% of transaction amount | Fraction of a cent |

| Intermediaries | Multiple | None (direct transfer) |

| Accessibility | Requires a bank account | Available to anyone with internet access |

| Scalability | Limited | 1,500 transactions per second |

This table underscores the advantages of using XRP for cross-border transactions, highlighting its speed, low cost, and accessibility.

Smart Contracts and Decentralized Applications

Ripple’s XRP is transforming cross-border transactions and making substantial progress in smart contracts and decentralized applications (DApps). Utilizing blockchain technology, XRP offers developers and businesses innovative opportunities to develop secure, efficient solutions.

The Potential of XRP in Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automatically enforce and execute the terms of a contract when predefined conditions are met, without the need for intermediaries.

XRP is increasingly being used to facilitate smart contracts, thanks to its fast transaction times and low fees. Although Ripple’s native smart contract platform, Codius, is currently on hold, the community and other developers are actively working to integrate smart contract functionalities into the XRP Ledger, demonstrating XRP’s versatility.

Examples of Decentralized Applications Using XRP

Decentralized applications (DApps) are applications that run on a peer-to-peer network, rather than being hosted on centralized servers. They leverage blockchain technology to ensure transparency, security, and decentralization.

XRP is being used as a foundation for various DApps, spanning different industries and use cases. Some examples include:

- Payment and Remittance DApps: Leveraging XRP for fast and low-cost cross-border transactions.

- Gaming and Virtual Goods: Using XRP for in-game purchases and trading of virtual goods.

- Decentralized Exchanges: Facilitating the trading of cryptocurrencies and other assets in a decentralized manner.

The Benefits of Using XRP for Smart Contracts and DApps

Using XRP for smart contracts and DApps offers numerous benefits:

- Speed: XRP stands out as one of the fastest cryptocurrencies available, with transactions typically confirming in just 4-5 seconds.

- Low Transaction Costs: Executing smart contracts or conducting transactions in DApps costs significantly less with XRP than with other platforms.

- Scalability: XRP can handle 1,500 transactions per second, ensuring that it can scale to meet the demands of even the most popular DApps.

| Feature | XRP | Ethereum | Other Blockchain Platforms |

|---|---|---|---|

| Transaction Speed | 4-5 seconds | Minutes (depending on network congestion) | Varies |

| Transaction Cost | Fraction of a cent | Can be high during peak times | Varies |

| Scalability | 1,500 transactions per second | 15-45 transactions per second | Varies |

| Smart Contract Capability | Developing (via third-party solutions) | Native support | Varies |

| Decentralization | Decentralized, with unique consensus mechanism | Fully decentralized | Varies |

This table highlights the advantages of using XRP for smart contracts and DApps, particularly in terms of speed, cost, and scalability.

XRP in Supply Chain and Asset Management

The versatility of Ripple’s XRP extends into the domains of supply chain management and asset tracking, where transparency, efficiency, and real-time data are paramount. By leveraging blockchain technology and the unique features of XRP, businesses can streamline their operations, reduce costs, and enhance accountability.

Streamlining Supply Chain Processes with XRP

Supply chains are complex networks that involve multiple parties, from manufacturers and suppliers to distributors and retailers. The traditional systems used to manage these networks are often siloed and lack real-time visibility, leading to inefficiencies and delays.

XRP can be utilized to create a decentralized ledger that records every transaction and movement of goods within the supply chain. This ensures that all parties have access to the same information in real-time, reducing discrepancies and improving efficiency.

The Role of XRP in Asset Tracking and Management

Asset tracking monitors the location and condition of valuable items, whether in transit or storage, ensuring their security and integrity. XRP enhances this process, offering a secure, transparent method to log and confirm all asset movements or condition changes. Utilizing smart contracts on the XRP Ledger, businesses can automate asset management tasks, including payments, settlements, and compliance checks, boosting efficiency and minimizing error risks.

Real-World Examples and Potential Benefits

Several companies and industries are already exploring or implementing XRP-based solutions for supply chain management and asset tracking. Some of the potential benefits include:

- Reduced Costs: By streamlining processes and reducing the need for intermediaries, businesses can significantly cut costs.

- Increased Transparency: The decentralized nature of the XRP Ledger ensures that all parties have access to the same information, increasing transparency and trust.

- Enhanced Security: The security features of the XRP Ledger protect against fraud and tampering, ensuring the integrity of the supply chain and asset management processes.

- Real-Time Visibility: The ability to access real-time data enables businesses to make more informed decisions and respond quickly to any issues that may arise.

Benefits of Using XRP in Supply Chain and Asset Management

- Transparency: All parties involved have access to the same real-time information, which helps in reducing discrepancies and building trust across the network.

- Efficiency: The use of XRP leads to streamlined processes and automated settlements, resulting in faster operations and reduced costs.

- Security: The security features of the XRP Ledger protect against fraud and tampering, ensuring the integrity of transactions and data.

- Real-Time Visibility: Having access to real-time data enables quick decision-making and efficient resolution of issues as they arise.

- Cost Reduction: The reduced need for intermediaries, combined with streamlined operations, leads to significant cost savings.

This list highlights the key benefits of utilizing XRP in the domains of supply chain management and asset tracking, showcasing its potential to enhance efficiency, security, and transparency in these areas.

XRP as a Tool for Financial Inclusion

Financial inclusion is vital for economic development, providing individuals and businesses access to beneficial and affordable financial products and services. Ripple’s XRP plays a crucial role in this area, aiming to connect unbanked and underbanked communities worldwide with essential financial resources.

Addressing the Unbanked and Underbanked

Many worldwide lack basic financial services due to missing banking infrastructure, geographical barriers, or socio-economic challenges. XRP offers a solution with its decentralized nature and capacity for fast, affordable transactions. Utilizing mobile technology and the XRP Ledger, people can access financial services via smartphones, eliminating the need for traditional banking infrastructure.

How XRP Can Provide Access to Financial Services

XRP enables a range of financial services that can contribute to financial inclusion:

- Remittances: XRP can facilitate faster and cheaper cross-border transactions, helping migrant workers send money back home to their families.

- Microtransactions: The low transaction costs associated with XRP make it ideal for microtransactions, enabling small-scale financial activities that are often not feasible with traditional banking systems.

- Access to Credit: By providing a secure and transparent ledger for transaction history, XRP can help individuals build a financial identity, potentially increasing their access to credit.

Challenges and Controversies

Despite facing challenges and controversies, Ripple and XRP have numerous applications and the potential to revolutionize various industries. It is crucial to address these issues to provide a balanced view of XRP’s journey and its future prospects.

Legal Challenges Faced by Ripple and XRP

Ripple Labs, the entity behind XRP, is currently facing significant legal challenges, including a notable lawsuit from the U.S. SEC. In December 2020, the SEC accused Ripple Labs of conducting an unregistered securities offering through their sale of XRP. Ripple Labs disputes these claims, asserting XRP is a currency, not a security, and should be exempt from securities regulations.

The SEC Lawsuit and Its Implications

The crypto community eagerly awaits the SEC lawsuit’s outcome against Ripple, understanding its potential to set a vital precedent. This precedent would influence how other cryptocurrencies are classified and regulated within the United States. If authorities classify XRP as a security, it could face stringent regulations, possibly hindering its use and overall adoption. Conversely, a victory for Ripple Labs could bring clarity and foster wider acceptance and integration of XRP.

Navigating Regulatory Hurdles

Ripple Labs actively engages with regulators, striving for compliance and showcasing their readiness to collaborate for XRP and other cryptocurrencies’ legal and innovative operation. The company is committed to fostering innovation and broadening adoption within established legal frameworks.

The Future of XRP: Beyond Banking

As we delve into the future prospects of Ripple’s XRP, it is evident that its potential extends far beyond the realms of banking and financial transactions. The continuous development, community support, and innovative applications of XRP paint a promising picture for its future.

Predictions and Potential Future Applications of XRP

The versatility of XRP opens up numerous possibilities for future applications. Here are some areas where XRP could play a significant role:

- Decentralized Finance (DeFi): With the growing popularity of DeFi, XRP could become a major player, providing faster and cheaper transactions for various DeFi applications.

- Internet of Things (IoT): XRP’s ability to handle microtransactions makes it well-suited for IoT applications, where devices can transact with each other seamlessly.

- Tokenization of Assets: XRP can tokenize a variety of assets such as real estate, stocks, or commodities, making trading and transferring ownership smoother and more efficient.

The Role of Community and Developer Support

The success and adoption of XRP are heavily influenced by the support and involvement of its community and developers. Ripple has fostered a strong community that actively participates in the network’s development, testing, and promotion. Furthermore, the company offers resources and support to developers, fostering innovation and facilitating the development of new applications on the XRP Ledger.

How Ripple is Fostering Innovation and Adoption of XRP

Ripple is committed to driving the adoption and innovation of XRP. Here are some of the ways the company is contributing to this effort:

- Investment in Startups: Through its investment arm, Xpring, Ripple invests in startups and projects that are building on the XRP Ledger, providing both funding and technical support.

- Partnerships and Collaborations: Ripple forms strategic partnerships with financial institutions, payment providers, and other companies to integrate XRP into various applications and services.

- Education and Advocacy: Ripple actively engages in educating the public and policymakers about XRP and blockchain technology, advocating for favorable regulations and broader adoption.

Conclusion

Ripple’s XRP has established itself as a versatile digital asset, going beyond traditional banking and financial transactions. Its quick transaction times, scalability, and affordability make it a top choice for various applications. These range from remittances and smart contracts to supply chain management and financial inclusion initiatives. Despite legal and regulatory hurdles, Ripple remains committed to XRP’s compliance, innovation, and long-term adoption.

Reflecting on XRP’s potential, it’s evident that it could transform industries and create a more inclusive financial ecosystem. The active XRP community and ecosystem drive continuous exploration, development, and engagement. This makes it an exciting era for both new and experienced individuals in blockchain and digital assets. XRP’s future is promising, showcasing the transformative potential of blockchain technology and its vast possibilities.