In the annals of financial history, the 21st century will be marked by a phenomenon known as “Crypto Cartography,” mapping the journey from rapid globalization to the revolutionary emergence of cryptocurrencies. As the world embraced digitalization, the fundamental nature of money experienced a radical transformation, giving rise to cryptocurrencies.

This section delves into the inception of this digital financial phenomenon and its evolution from traditional currencies to the decentralized digital assets we recognize today.

The Traditional vs. The Digital

For centuries, tangible assets like gold, silver, and printed bills defined money, with central banks regulating its flow to ensure system stability and trust. Yet, as the digital age dawned and the internet erased geographical barriers, a new currency vision emerged—one decentralized and digital, designed to cross borders with ease.

| Traditional Currency | Cryptocurrency |

|---|---|

| Centralized control by banks or governments | Decentralized and operates on peer-to-peer networks |

| Tangible and physical (e.g., coins, notes) | Intangible and digital |

| Value often tied to physical commodities (e.g., gold) or trust in a government | Value derived from supply, demand, and trust in the underlying technology |

| Transactions can require intermediaries and can take time | Direct transactions that can be instantaneous |

The Need for a New Currency

The 2008 financial crisis laid bare the frailties of the traditional banking system, eroding trust in centralized financial institutions. In response, a growing chorus called for a new system that could facilitate money exchange without intermediaries, excessive fees, or the risks of centralized oversight. Bitcoin emerged as the answer.

Satoshi Nakamoto, a pseudonym for an individual or group, unveiled Bitcoin in 2009, branding it a “peer-to-peer electronic cash system.” This wasn’t merely a new currency; it represented a fundamental shift away from the traditional financial systems. Bitcoin operated on a decentralized network, harnessing cryptographic principles to bolster security, transparency, and integrity.

The Ripple Effect

Bitcoin’s introduction set off a domino effect in the financial world. It demonstrated that it was possible to have a currency system that didn’t rely on central banks or physical commodities. This decentralized model opened the door for innovations, leading to the creation of thousands of other cryptocurrencies, each with its unique features and purposes.

The Genesis of Cryptocurrencies: Bitcoin and Beyond

The story of cryptocurrencies is incomplete without delving into its roots. At the heart of this digital revolution lies Bitcoin, the pioneer that paved the way for a myriad of other digital currencies. But what led to its creation, and how did it inspire a whole new world of financial possibilities?

The Vision of Satoshi Nakamoto

Following the 2008 financial meltdown, an anonymous entity known as Satoshi Nakamoto published a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” The paper did more than critique the existing financial system; it laid out a blueprint for an alternative one. Nakamoto envisioned a system enabling direct transactions between parties, free from central authority or intermediaries, anchored in transparency, security, and decentralization.

Birth of Bitcoin

In January 2009, Satoshi Nakamoto mined the ‘genesis block’, the first block on the Bitcoin blockchain. This block carried a message referencing a headline from The Times: “Chancellor on brink of second bailout for banks.” This message did more than just mark Bitcoin’s beginning; it highlighted its mission to offer an alternative to the failing traditional banking system.

Bitcoin’s decentralized structure opened the doors for anyone to join the network, validate transactions, and mine new Bitcoins, shifting the balance of power from centralized financial institutions to a more democratized user base.

The Rise of Altcoins

While Bitcoin was the trailblazer, it wasn’t long before other cryptocurrencies, often referred to as ‘altcoins’, began to emerge. These altcoins, such as Ethereum, Litecoin, and Ripple, were not mere replicas of Bitcoin. Each brought its unique features, functionalities, and visions to the table.

- Ethereum: Introduced by Vitalik Buterin, Ethereum expanded on Bitcoin’s capabilities by introducing smart contracts—self-executing contracts with the terms of the agreement directly written into code. This allowed for more complex and customizable transactions.

- Litecoin: Created by Charlie Lee, Litecoin was often considered the silver to Bitcoin’s gold. It offered faster transaction times and a different hashing algorithm.

- Ripple (XRP): Unlike most cryptocurrencies that target individual users, Ripple aimed to provide solutions for banks and financial institutions, facilitating real-time global payments.

The Significance of Decentralization

The decentralized nature of cryptocurrencies is perhaps their most defining and revolutionary feature. By operating on a peer-to-peer network, cryptocurrencies eliminate the need for intermediaries, reducing costs and increasing transaction speeds. More importantly, decentralization democratizes financial power, giving control back to the individual users.

The Expanding Cryptoverse: Beyond Bitcoin

As the world began to recognize the potential of Bitcoin, the cryptocurrency landscape started to expand exponentially. This expansion wasn’t just in terms of market capitalization or user adoption, but also in the diversity of digital assets available. The term ‘cryptoverse’ aptly captures this vast and varied universe of cryptocurrencies.

The Allure of Altcoins

Bitcoin, while maintaining its status as the most recognized and valuable cryptocurrency, shares the stage with the captivating world of altcoins. These alternative coins bring their unique features and purposes to the table, addressing a spectrum of market needs and niches.

Firstly, utility tokens stand out with their specific roles within a project’s ecosystem. Take Ether (ETH), for example, which powers the Ethereum platform by enabling the execution of smart contracts.

Moreover, stablecoins bridge the gap between traditional and digital finance. They are tied to stable assets like the US Dollar or gold, offering the best of both worlds: cryptocurrency flexibility coupled with fiat currency stability. Tether (USDT) and USD Coin (USDC) are prime examples of this category.

Finally, in an era where privacy is a rare commodity, privacy coins come to the forefront. Monero (XMR) and Zcash (ZEC) provide enhanced privacy features, ensuring transactions remain confidential and virtually untraceable.

The Concept of “Altseason”

Within the crypto community, the term “altseason” describes a phase where altcoins experience significant price gains that outshine Bitcoin’s performance. Driven by factors like technological breakthroughs, regulatory updates, or shifts in market sentiment, these periods present a mix of opportunities and challenges to investors.

Tokenization: Everything is Fair Game

The concept of tokenization stands out as a revolutionary aspect of the growing cryptoverse. It allows for the conversion of almost any valuable asset into digital tokens, ranging from real estate and art to intellectual property and personal time. This innovation opens up access to diverse asset classes and injects remarkable liquidity into markets that have traditionally been illiquid.

Challenges in the Expanding Cryptoverse

While the growth and diversity of the cryptoverse offer numerous opportunities, they also present challenges:

- Volatility: The crypto market is known for its wild price swings, which can be a double-edged sword for investors.

- Regulatory Uncertainty: As governments and regulatory bodies grapple with the implications of cryptocurrencies, the landscape remains uncertain in many jurisdictions.

- Security Concerns: With the rise of digital assets, there’s also been an increase in cyber threats, from exchange hacks to phishing attempts.

The Mechanics Behind Cryptocurrencies: The Engine of the Digital Revolution

The allure of cryptocurrencies isn’t just in their potential as an investment or their promise of decentralization. At the heart of this revolution lies a groundbreaking technology: the blockchain. Understanding the mechanics behind cryptocurrencies is crucial for anyone looking to navigate the cryptoverse effectively.

Blockchain: The Digital Ledger

At its core, a blockchain is a digital ledger that records transactions in a secure, transparent, and immutable manner. Each ‘block’ in the chain contains a set of transactions, and once added, the data within these blocks cannot be altered without changing all subsequent blocks, which requires the consensus of the network.

- Decentralization: Unlike traditional databases, such as a SQL database, which are centralized, blockchains are decentralized and distributed across a vast network of computers, known as nodes.

- Transparency: Every transaction on the blockchain is visible to anyone and can be verified by the network.

- Security: Transactions must be confirmed by network participants through cryptographic algorithms, making unauthorized changes extremely difficult.

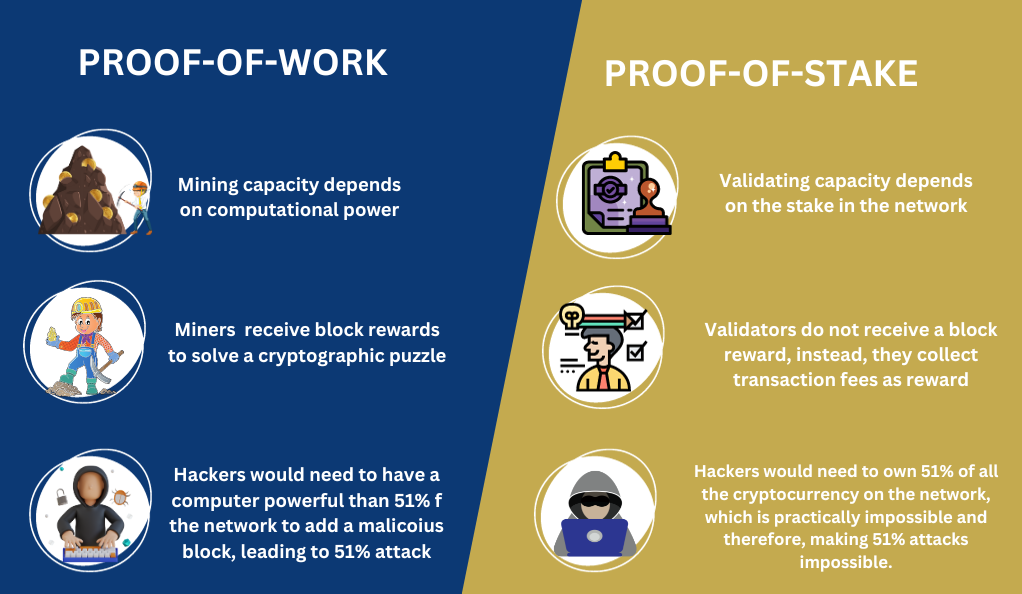

The Role of Miners

Miners play a pivotal role in the cryptocurrency ecosystem. They use computational power to solve complex mathematical problems, a process known as proof-of-work (PoW). Once the problem is solved, the miner adds a new block to the blockchain and is rewarded with newly minted cryptocurrency. This process not only validates and records transactions but also introduces new coins into the system.

From Proof-of-Work to Proof-of-Stake

While PoW has been the dominant consensus mechanism, it’s often criticized for its environmental impact due to the high energy consumption of mining operations. As a result, the crypto community is exploring alternative consensus mechanisms:

- Proof-of-Stake (PoS): Instead of relying on computational power, PoS validators are chosen based on the number of coins they hold and are willing to “stake” or lock up as collateral. It’s seen as a more energy-efficient alternative to PoW.

- Delegated Proof-of-Stake (DPoS): A variation of PoS, where coin holders vote for a few representatives to validate transactions on their behalf.

- Proof-of-Authority (PoA): Transactions are validated by approved accounts, known as validators. It’s more centralized than PoW or PoS but offers faster transaction times.

Smart Contracts: Beyond Transactions

One of the most transformative applications of blockchain technology is the smart contract. These are self-executing contracts with the terms of the agreement directly written into lines of code. They automatically enforce and execute the terms of a contract when certain conditions are met, eliminating the need for intermediaries and reducing risks of fraud.

The Economic Implications of Cryptocurrencies: Disrupting the Financial Status Quo

Cryptocurrencies, once a niche and esoteric concept, have rapidly evolved into formidable financial instruments with the potential to reshape global economies. Their rise has sparked debates among economists, policymakers, and industry leaders about their long-term implications. Let’s delve into the economic ramifications of this digital revolution.

Cryptocurrencies as a Store of Value

Traditionally, assets like gold have been considered reliable stores of value, preserving wealth across generations. Bitcoin, often referred to as ‘digital gold’, has emerged as a contemporary store of value. Its fixed supply (capped at 21 million) and decentralized nature make it resistant to inflationary pressures, a feature that’s particularly appealing in economies experiencing hyperinflation.

Decentralized Finance (DeFi): The New Frontier

DeFi, or decentralized finance, represents a shift from traditional centralized financial systems to protocols that operate without intermediaries. Built primarily on the Ethereum blockchain, DeFi platforms offer services like lending, borrowing, and trading, all executed through smart contracts.

- Financial Inclusion: DeFi has the potential to bring financial services to the unbanked, offering them access to loans, savings, and insurance without the need for traditional banks.

- Yield Farming: Users can earn returns by lending their assets or by providing liquidity to decentralized exchanges, a phenomenon known as yield farming.

The Regulatory Conundrum

The meteoric rise of cryptocurrencies has caught the attention of regulatory bodies worldwide. Their decentralized nature poses challenges to traditional regulatory frameworks.

- Taxation: How should cryptocurrency gains be taxed? As property, currency, or something entirely new?

- Consumer Protection: With the rise of crypto scams and the volatile nature of the market, how can consumers be protected?

- Monetary Policy: Can central banks maintain effective monetary policies in a world where cryptocurrencies are widely adopted?

The Environmental Debate

The environmental impact of cryptocurrencies, particularly those that use proof-of-work consensus mechanisms, has been a topic of intense debate. The energy consumption of large-scale mining operations, especially in regions reliant on non-renewable energy sources, has raised concerns about the carbon footprint of cryptocurrencies.

The Future of Central Banks and Fiat Currencies

With the growing adoption of cryptocurrencies, questions arise about the future role of central banks and the fate of fiat currencies.

- Central Bank Digital Currencies (CBDCs): Many central banks are exploring the idea of launching their digital currencies. These CBDCs could combine the benefits of cryptocurrencies, like fast transactions and security, with the stability and trust of traditional currencies.

- The Threat to Fiat: Will cryptocurrencies replace fiat currencies, or will they coexist? The answer might vary from one economy to another, depending on factors like technological adoption, regulatory stance, and economic stability.

Navigating the Crypto Marketplace: A Guide to the Digital Bazaar

The crypto marketplace is a bustling digital bazaar, teeming with opportunities, innovations, and challenges. From exchanges that facilitate the buying and selling of digital assets to initial coin offerings that fund new projects, understanding the intricacies of this marketplace is crucial for both novices and seasoned crypto enthusiasts.

Cryptocurrency Exchanges: The Trading Hubs

At the heart of the crypto marketplace are cryptocurrency exchanges. These platforms allow users to buy, sell, and trade a variety of digital assets.

- Centralized Exchanges (CEX): These are platforms operated by centralized entities, much like traditional stock exchanges. Examples include Binance, Coinbase, and Kraken. They offer high liquidity, user-friendly interfaces, but come with potential security risks due to their centralized nature.

- Decentralized Exchanges (DEX): Operating without a central authority, DEXs facilitate peer-to-peer trades. Platforms like Uniswap and SushiSwap have gained popularity for their reduced risk of hacks and enhanced user privacy.

Initial Coin Offerings (ICOs) & Beyond

ICOs revolutionized the way projects raised capital in the crypto space. Instead of traditional fundraising methods, projects could issue tokens to investors.

- The ICO Boom: Around 2017, the crypto space witnessed an ICO boom, with numerous projects raising millions. However, the lack of regulation also led to many scams.

- Security Token Offerings (STOs): As a more regulated alternative to ICOs, STOs involve the sale of security tokens, which represent ownership in an underlying asset or company.

- Initial DEX Offerings (IDOs): These are token sales conducted directly on decentralized exchanges, offering immediate liquidity and trading.

Wallets: Safeguarding Digital Treasures

For anyone venturing into the crypto marketplace, understanding and choosing the right wallet is crucial. Wallets are digital tools that allow users to store, send, and receive cryptocurrencies.

- Hot Wallets: These are connected to the internet and provide easy access to funds. However, they are vulnerable to online attacks.

- Cold Wallets: These are offline storage solutions, like hardware wallets, that offer enhanced security by keeping private keys away from internet access.

Navigating Volatility: A Trader’s Reality

The crypto marketplace is known for its price volatility. While this can offer lucrative trading opportunities, it also comes with significant risks.

- Market Analysis: Traders often rely on technical and fundamental analysis to predict price movements and make informed decisions.

- Risk Management: Setting stop losses, diversifying portfolios, and staying informed are essential strategies to navigate the volatile crypto waters.

Charting the Course

The crypto marketplace is a labyrinth of platforms, tools, and financial instruments, brimming with opportunities for the intrepid navigator. Success in this arena hinges on education, thorough due diligence, and a well-defined strategy. Reflecting on our journey through the crypto landscape, its transformative power and the bright prospects it offers for the future of finance become abundantly clear.

Conclusion: Reflecting on the Digital Renaissance

The rise of cryptocurrencies marks a pivotal shift in the financial landscape, challenging the traditional notions of currency and transactions. This digital revolution promises a future of decentralized finance, offering greater transparency and inclusivity.

Despite the challenges ahead, including regulatory hurdles and environmental concerns, the potential for a more democratized financial system is a compelling narrative that continues to attract global attention. As we look to the future, the crypto journey is not just about embracing new technology but about reshaping the very fabric of economic exchange.